In the classic film, 'It's a Wonderful Life,' the protagonist, George Bailey, faces his worst nightmare, a run on the bank his family built. The film encapsulates the massive impact across a community when a bank collapses. The concept of a 'bank run' or 'deposit flight' is a terrifying prospect for any financial institution as it shows clients have lost trust in the bank; as a result, customers withdraw their money, usually removing funds swiftly and in their entirety. However, Bank runs are nothing new. In the 'Panic of 1893,' thousands of banks were adversely affected by clients removing money, resulting in a deep depression across the USA. Unfortunately, this cycle seems to repeat itself; the depression of the 1930s was underpinned by banks extending too much credit; the 2008 financial crisis has been attributed to risky decisions based on the availability of cheap credit.

A bank run occurred on March 9, 2023, at Silicon Valley Bank (SVB). By the next day, the regulators, the California Department of Financial Protection & Innovation, took control and shut SVB down. Since then, the banking sector has reeled, wobbled, and stood its ground, but there have been casualties. Here we look at what happened, what may have caused the closure of SVB, and why it is vital to think of banking as a connected ecosystem.

Was trust behind the SVB collapse?

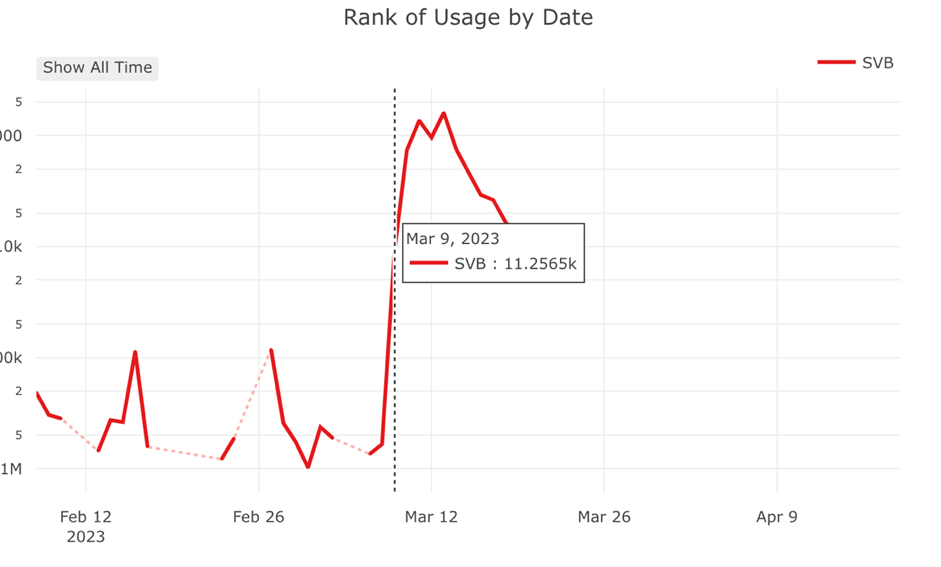

SVB may have been a smaller bank, but it was important; it helped tech startups, otherwise turned away by other financial institutions, get the financial support needed to bring products to market. This critical role should not be underestimated. As a central pivot within the startup and founder community, SVB was a pillar of innovation. But risky decisions often must be made to stand out from a crowd. It didn't take much to cause the run on SVB that resulted in its demise. All that was needed was for fear to spread. In the preceding days leading to the collapse of SVB, a series of messages were shared in WhatsApp groups; investors, with startups holding multiple millions of dollars in SVB, advised a 'safety first' approach and to remove funds from the bank. Twitter also chimed into the debate, helping to spread the fear far and wide - the image below shows the surge in the number of tweets concerning SVB in the run-up to the collapse:

Source: StoryWrangling nGrams

The question of where this fear originated is crucial in analyzing the situation. The failure of SVB, a bank that placed bets on high-risk tech startups, failed the old-fashioned way; the bank had more liabilities than assets. Customers became fearful when SVB attempted to raise more cash to fix the gap. The resultant run will go down in banking history. Ultimately, people, market forces, and fear caused the demise of a significant bank.

Why SVB failed and the ripple effect

The European Central Bank (ECB) sets out four clear reasons why a bank fails:

- it no longer fulfils the requirements for authorisation by the supervisor

- it has more liabilities than assets

- it is unable to pay its debts as they fall due

- it requires extraordinary financial public support

SVB fits neatly into number two in the ECB’s list.

The ECB also points out that the interconnected nature of banking makes the financial ecosystem vulnerable.

“Furthermore, the financial system is highly integrated. The recent financial crisis (2008) has shown how quickly and forcefully problems in the financial sector can spread if not effectively tackled.”

When a bank fails it often happens very quickly. The result often sends ripples across, across other banks; in the case of SVB, Signature Bank was next in line, with customers withdrawing over $10 billion from their accounts within days of the demise of SVB. A week later, Credit Suisse failed - although in the case of Credit Suisse, the reason for its collapse was a long time coming. Check out the Eastnets post on the failure of Credit Suisse for further insights.

An important but sometimes missed concept in banking is that banking is as much about people and their behavior as it is about money. People make decisions that can have a material impact on banks and the infrastructure that controls financial transactions. Bank runs result when people lose trust in a bank; trust is a critical element of robust banking; once it is gone, the bank becomes vulnerable. But why did SVB suddenly lose the trust of its customers? The answer has been alleged to lie in SVB's history and culture and is exacerbated by the lack of regulatory control.

Reports from the Financial Times suggested that the bank had become 'complacent in terms of risk' and even pointed to a culture of a remote workforce making management more difficult. The bank also placed bets on the wrong horse: SVB invested in US government bonds, as this is a traditional 'safe bet.' However, as the US Federal Reserve began to raise interest rates in 2022 to counterbalance soaring inflation, the value of the bonds fell. The result was a house of cards that collapsed under the strain.

There has been some debate around the question, "if the bank had come under the same stringent regulatory controls as other banks, would this situation have arisen?"

Did Dodd-Frank fail SVB?

The Dodd-Frank Wall Street Reform and Consumer Protection Act was legislation after the 2008 banking crash. If lessons are to be learned, it is that regulations are there for a reason. When Obama signed the Dodd-Frank Act, he did so to ensure that the excessive risk-taking that led to the 2008 crash did not happen again. This Act was enacted to protect the entire financial ecosystem from bank to customer. However, lobbyists soon joined forces to water down the Act. One of the lobbying groups, which included SVB CEO, Greg Becker, wanted to see a relaxation of Dodd-Frank Act requirements for banks with between $50 billion and $250 billion in assets. In 2018, the lobbyists pushing for these derogations were satisfied by the legislation encapsulated in the Economic Growth, Regulatory Relief and Consumer Protection Act: SVB fitted neatly into this category.

Without the oversight provided by the Dodd-Frank Act, SVB did not have to abide by certain conditions, such as engaging a Chief Risk Officer (CRO). The Frank-Dodd Act stipulates that covered entities must designate a “Chief Risk Officer (CRO) responsible for implementing and maintaining the risk management framework and practices approved by the risk committee.”

SVB had a gap of around eight months without a CRO during 2022; a crucial period where the bank entered a high-risk zone. If they had ensured the continuity of employment of a CRO, the risk inherent in US bonds may have been identified in time to save the bank. However, the reality may be more complex than this, with multiple variables coming together to cause a cascade effect.

An integrated, interconnected ecosystem called banking

The full array of interrelated reasons for the failure of SVB will no doubt continue to cause debate across the industry. However, the repercussions of the impact of this influential bank remain to be seen.

As the ECB noted, the financial sector is highly integrated. As the financial sector has become increasingly globalized and digitized, this integrated ecosystem has facilitated innovation in banking. But banking is still about people and trust. The failure of SVB may have been mired in markets and culture, but the house of cards collapsed when trust went out of the window. Trust is woven deeply into banking; it resides in how banks govern their operations; trust is imbued in the security of transactions; trust is inherent in the beating heart of financial system communications.

Time will tell if 2023 experiences a repeat of the previous financial crashes, often preempted by bank runs and subsequent bank collapses. The balancing act that is modern economic systems will continually be tested by elements such as geopolitical tensions, technological innovation, and human behavior. The failure of SVB sent a shock wave across the tech sector, but it may also have repercussions in the broader financial marketplace. Nothing in the financial sector acts in isolation. Industry must accept the integrated nature of banking and ensure that every possible mechanism is used to mitigate risk.